7 Reasons Why Building New Trumps Buying Old

We hear it all the time from our clients – ‘Why would I risk building a brand new home when I can buy an established home for the same price’? Well, the answer is simple, take a good look at the property’s numbers, because the numbers don’t lie. Once our clients see the numbers on a brand-new Property Solution, they never go back to considering an established home for a long-term, set, and forget investment property. We use sophisticated licensed Property Investment Analysis (PIA) software, to generate forecasted numbers on how a property will perform over the long term. In this article, we will do a deep dive into 7 reasons why building brand new trumps acquiring an established property.

1. Better Depreciation Benefits

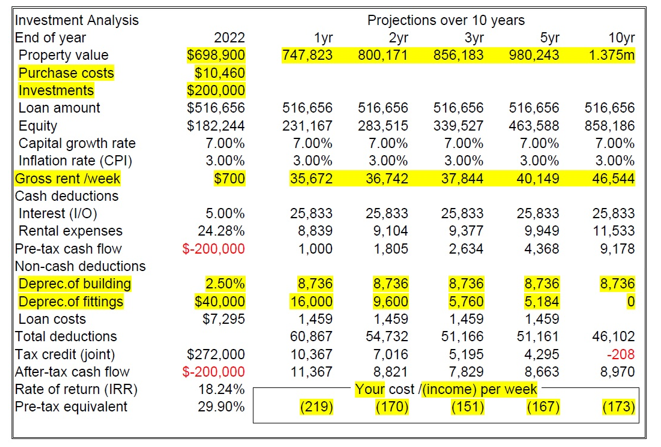

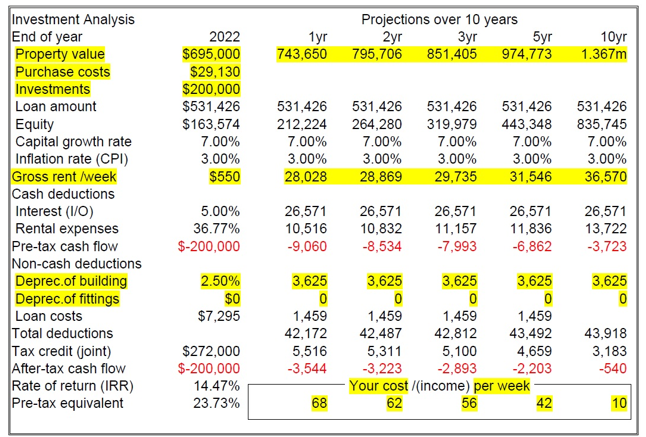

If you are acquiring an investment property for the intended purpose to create passive income you can depreciate 2.5% of the cost of the building over 40 years. This type of deprecation still applies to established properties but only for the balance of time to 40 years and only based on the original build cost of the house in the year it was built. For example, if you acquire a 30-year-old property today, you can only depreciate the build cost for another 10 years before this benefit is maxed out. You are also stuck depreciating the build cost for a 4-bedroom home 10 years ago that may have cost say $280,000 which means you can only deduct $7,000 ($280,000 x 2.5%) per year for the next 10 years. Whereas, if you build a brand new 4-bedroom home today that costs, say $575,000 then you get to depreciate $14,375 ($575,000 x 2.5%) per year for the next 40 years. This has a huge, positive impact on the numbers over the long term.

However, for the fixtures, fittings, and appliances, the tax rules changed in 2017 and only brand-new properties can claim this type of depreciation. As soon as the property has been lived in, even for one day, it no longer qualifies for this type of deprecation which has a massive impact on an investment property’s numbers. We always use diminishing value depreciation in our numbers because it brings forward depreciation benefits, which front-loads the cash flow. This is ideal because rents typically go up over time to support ongoing cash flow after the depreciation benefits have been reduced more rapidly in earlier years.

2. Lower Stamp Duty & Closing Costs

Building brand new means that you only need to pay stamp duty on the land component and not its improved value, i.e., the house. This is a huge initial saving. In the examples provided, the PIAs reveal two different stamp duty figures: Brand-New of $10,460 vs Established of $29,130. Another downside of stamp duty is you can’t claim it off tax. If you purchase an existing property and pay $29,130 in stamp duty, that money is gone forever, whereas you would only lose $10,460 in stamp duty costs if you purchased a brand-new Property Solution. The less of your cash you have towards the cost, the more you can put in towards your deposit, and the better the net cash flow.

Projections

Brand New Established Numbers

3. Warranty

Although not typically expressed in forecast numbers, warranties can mean significant cost savings if something goes unexpectedly wrong. Fixtures, fittings, and appliances are typically covered by up to 12 months under a manufacturer warranty. Builders are also obligated to rectify any identified defects at practical completion. Furthermore, Builders are also required to provide a structural Homeowners Warranty that is covered for a period of up to seven years depending on which state you acquired your new property in. Each state has its own insurance scheme to support any Homeowner Warranty claims. It is food for thought that if you buy an established property, there is no recourse should you inherit a latent structural defect, that was not identified in a building report. This could mean big bucks in rectification works to keep the property inhabitable for tenants to occupy.

4. Commanding a Higher Rental Income

Shiny new objects get people’s attention, which shows in the price people are willing to pay in rent when compared to an established home with a less desirable layout and appearance. Tenants will always pay a premium for a more modern designed home. In the example PIAs showed below, the numbers reveal that the rental income is expected to be $700 per week for the Brand-New home whereas it’s expected to be $550 per week for the older, Established home.

Moreover, newer estates are being curated for maximum enjoyability by the entire community, where residents are within closer proximity to amenities. Again, tenants are willing to pay a premium to have everything they need closer to their homes ultimately resulting in less commute time to enjoy a meal at a café, work at a co-working space, exercise at a park, or gym, or buy groceries from a large chain supermarket.

5. Fewer Maintenance Costs

Older things break more often and if you have an established home, you have a never-ending maintenance contract. From an investment perspective, this may mean that you need to make a bigger annual allowance for maintenance costs for things like hot water systems, air conditioners, dishwashers, and other appliances that are the responsibility of the landlord, not the tenant. Emergency rectification is a real issue too if you have old plumbing you may need to pay a premium for emergency work in the middle of the night. Ultimately more costs like this mean less cash flow for you as an investor.

6. Better Cash Flow

Numbers, numbers, numbers, we are all about a property’s numbers because that is how we judge a property’s performance. When conducting a PIA, the thing we focus on most is the cash flow. A property’s cash flow is the net result of all the inputs and outputs. If you look at the two examples provided, the net weekly cash flow for year 1 for the Established home is $68, whereas the Brand-New home is $219. When it comes to property investment, we believe that Cash Flow Is King and that is why we have developed our Co-Living and NDIS / SDA Property Solutions that focus on generating better yields than traditional investment properties. Please note that the PIA provided is on a side-by-side analysis of a traditional 4-bedroom home.

7. Higher Resell / Refinance Value

Many of our investor clients acquire a brand-new Property Solution as part of a Mortgage Elimination Strategy and part of that strategy is to sell the property once they achieve around $300,000 in equity growth. They then take that big chunk of equity and pay down their home mortgage shaving decades off the life of their mortgage. This is very achievable when selling into a secondary market because selling a home built five years earlier will usually get a better result than a house built 30 years ago. A lot of the growth occurs in those first few years if you time the acquisition correctly by choosing the right location. Reselling a 5-year-old home will attract a wider pool of buyers and create competitive tension at auction.

Some of our other investor clients are looking to generate passive income for retirement and have no intention to sell their property. It is these savvy folks that enjoy the uplift in value that they can refinance against to extract equity for their next acquisition. The same principle holds true here too, a 5-year-old home will value a lot better than a house built 30 years ago.

If you want to learn more about how to craft a property Strategy to suit your unique situation, then please reach out to the team today.