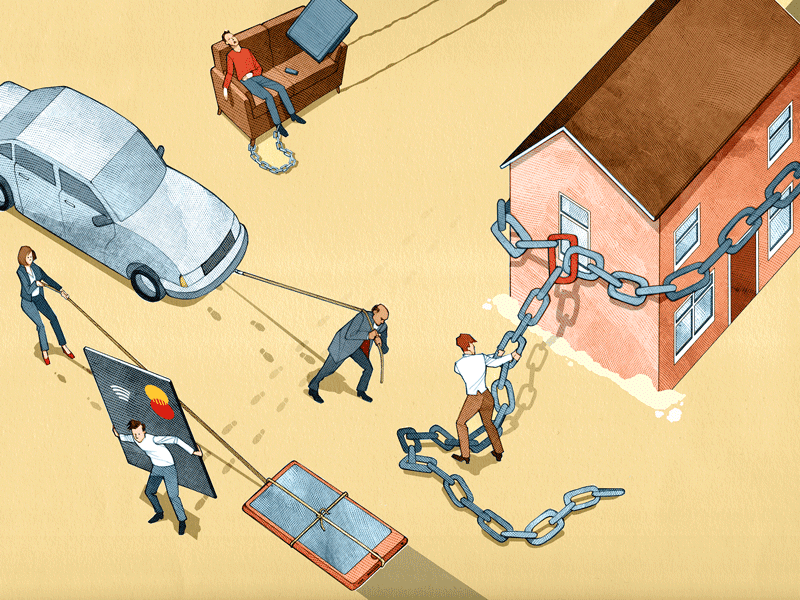

Breaking Debt Shackles

Why do some people have multiple investment properties, but most people only have two, one or none? Could it be that some people have learned how to game the system? What if we told you that its not a fancy degree that can unlock this secret, but simply making the right decisions about debt at the right times in your life. Let’s take a closer look at how to break debt shackles.

Let’s say you own your family home and have no investment properties. You have owned your property for a few years and its worth roughly $900,000 and you owe about $500,000. That $500,000 is personal debt and is smashing your available servicing capacity. Banks will usually allow 40% of your household income to service personal debt. Whereas they will allow up to 80% of the expected rental income for serving a mortgage on an investment property. In other words, investment income is about twice as effective to acquire debt when compared with personal income. The point is that you need to get rid of personal debt as soon as humanly possible, but how do you get rid of it quickly? Most people’s plan is to work really hard for the next 30 years and take some time off when they retire at 65. Fortunately, there is a better way and it’s about working smarter, not harder over 5 to 10 years.

It may seem counter intuitive to go into more debt but that is exactly how you break the debt shackles. Let’s show you how.

The best time to plant a tree is ten years ago, the second-best time is now. The same rings true for buying an investment property. After reviewing many investment options, you decide that positive cash-flow makes the most sense for your unique situation.

Assuming you can service a higher debt load, your first step is to refinance with Bank A, against your home to unlock the available, lazy equity in the form of a line of credit.

$900,000 value x 80% Loan to Value Ratio = $720,000 new mortgage limit

Less existing $500,000 mortgage

Equals up to $220,000 available equity to work with in offset account

DON’T buy a new sports car, boat, or go on a safari with this money! This money is to get you out of debt slavery only.

You decide on a fully managed, Co-Living Property Solution for $780,000 that will pay about a 7% gross yield and pays about $300 p/w positive cashflow. Bank B then lends 80% of total acquisition cost being $624,000 at say 5% pa. The equity, closing costs, furniture package and buffer come from your offset account from Bank A, also at say 5% pa. As a simple rule, if you are borrowing at 5% pa but making 7% pa on your asset, you are in front by 2% pa. That’s why positive Cashflow is King. The beautiful part of this strategy is that all the interest is tax deductible, meaning the effective interest rate is actually less depending on your marginal tax bracket.

The above Property Solution will put about $15,000 ($300 p/w) back into your offset account each year. Meaning you reduce your debt while the property grows in value over time.

Now comes the hard part… playing the waiting game. This strategy requires ‘stick-to-itiveness’ to work its magic. Don’t get complacent and use the surplus cashflow, put it to good use.

You only need to wait until the property has gone up in value enough to double your equity. Let’s say it takes 5 years. If you time your entry and exit points correctly in line with our Property Clock (below), then this could happen a lot sooner.

At an assumed 5% pa growth rate the property will reach around $950,000 in approximately 4 years. By holding the property for this length of time, you will qualify for a Capital Gains Tax (CGT) discount. Here are some rough numbers to illustrate the possible outcome, assuming a 35% marginal tax rate:

Sale Price = $950,000 less Agent Sales Commissions of $20,900 ($950,000 x 2.2% Incl-GST)

Net Realisation Value = $929,100

Less Original Purchase Price of $780,000

CGT Including CGT Discount = $26,092.50 ($149,500 x 50% = $74,550 x 35% Marginal Tax)

Approx Net Capital Gain = $123,008

Positive Cashflow = $60,000 ($15,000 x 4 years)

Offset account equity coming back = $180,000 approx.

Total cash back to apply towards mortgage = $363,000

New mortgage amount = $357,000 ($720,000 – $363,000)

If you had good stick-to-itiveness and applied the additional cashflow to your mortgage along the way, then you will have reduced your mortgage by about $360,000 over 4 years by selling this asset at the right time in the property cycle.

Now let’s rinse and repeat the process, this time with a higher personal residence value of say $1,100,000 (4 years of capital growth at approx. 5% pa).

$1,100,000 x 80% Loan to Value Ratio = $880,000 new mortgage limit

This will allow about $523,000 ($880,000 – $357,000) in your offset account that can be used to acquire 2 to 3 investment properties in key locations about to undergo capital growth.

This is it. This is how you break debt shackles and bust through the glass ceiling. This is how you forge your path towards multiple investment properties and financial freedom, in about 5 to 10 years.