3 Cures for a Financial Christmas Hangover

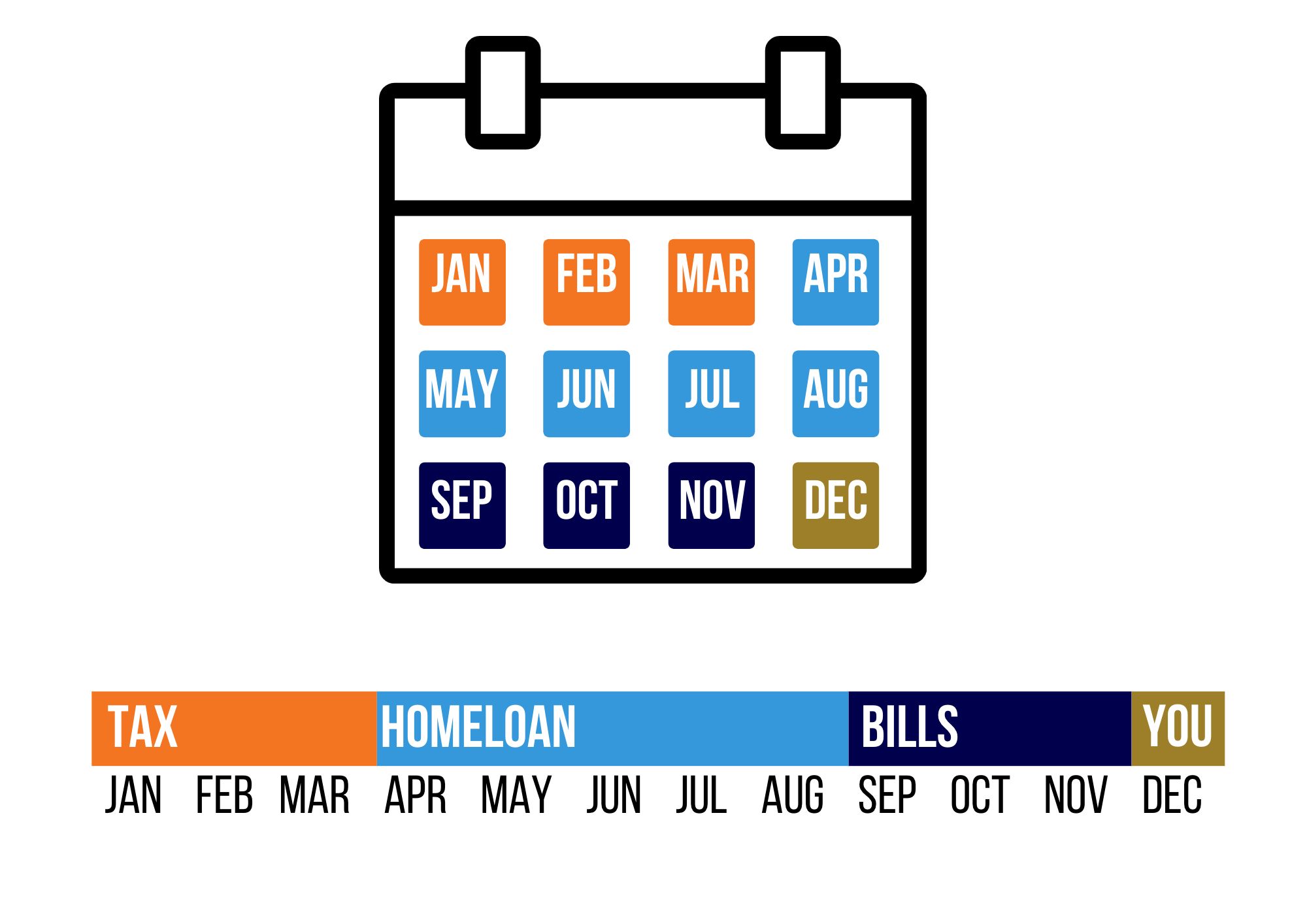

Christmas is a wonderful time to spend with family and friends, but gee-wiz it can be expensive! In an inflationary environment with a rising cost of living and mortgage rate hikes, seldom do we catch a financial break and Christmas can put excess strain on already stretched personal resources. The good news is that a new year comes with new resolutions and a fresh start to make up for any lost ground during 2022. In this article, we will outline three easy steps to get your financial game rolling again in 2023.

1. Start a Family Budget

It’s not rocket science; you will never get ahead financially if you spend more than you earn. And you will never know what you spend unless you measure your various expenditures. There are many great, free budget planners on the web to help you on this front. Here are just a few to choose from a plethora of choices –

https://moneysmart.gov.au/budgeting/budget-planner

https://www.commbank.com.au/digital/calculators/budget-planner-calculator

https://www.suncorp.com.au/banking/budget-planner-calculator.html

At the end of the day if you are not putting away surplus cash each and every month then you probably won’t ever be financially free. But don’t go overboard here having all your surplus cash in the bank, earning a pittance on your savings. A regimented savings plan alone isn’t going to help you achieve financial freedom. Especially when the inflation rate is chewing away your purchasing power. With an inflation rate of 5%, then every $1 in the bank is only worth a meagre $0.95 in one year’s time, this is of course offset by any interest you make. But also bear in mind you need to pay tax on this earned interest too. This is why renowned financial educator Robert Kyosaki always says that “savers are losers” because inflation is a hidden tax, that favours those with appreciating assets and punishes those without. Our most successful clients invest into real estate by putting their surplus cash into a high-income-producing smart investment property that outpaces the rate of inflation. The key is to accumulate surplus cash today for investing tomorrow in the right locations about to undergo a cycle of significant growth.

2. Debt Consolidation

If considering a refinance, one other tip may be to establish an Offset Account attached to your mortgage and move surplus savings into this account. It is far better to reduce the cost of your mortgage costing you, say 5% per annum instead of getting, say 3% per annum in a high-yielding bank account or fixed-term deposit. Having the discipline to keep a big chunk of surplus cash in your offset account can shave years off your mortgage. It may also be worthwhile considering taking a win on other assets such as shares that can be liquidated quickly and used to top up your Offset Account. We always urge our readers to consider their personal tax implications with their professional advisors before deciding to sell any assets subject to capital gains tax.

3. Pay off Your Mortgage Ahead of Schedule

The good news is that you don’t have to roll over and take this, you can do something about it. It’s all about working smarter and not harder to reduce your mortgage as fast as humanly possible, without taking on unnecessary risk. It may take a bit of mental tenacity to do something you have never done before but making the decision to invest into real estate is worth it in the long run. Picture a life on your terms where you have the choice and control over the number of days you work each week. Not because you need to work to pay your bills, but because you are drawn to a calling that you love. This is entirely possible, and we can show you how to eliminate a sizable chunk of your mortgage in about five years, to give you this level of financial freedom. You can read more about precisely how to achieve this in our step-by-step article, Breaking Debt Shackles.