Jan 20, 2023 | Property Investment

Good Debt VS Bad Debt Have you ever thought about debt being good or bad? Has it ever crossed your mind to ask if there was a difference? Well, there is and it’s a fairly significant one, let’s take a look at why. Your home mortgage is bad debt because you can’t...

Jan 20, 2023 | Property Investment

Cash Flow is King We are sure you have probably heard the adage – ‘Cash is King’, and for the most part, you would probably agree that it’s fairly accurate. A bit like ‘he who has the gold, makes the rules’, which is also on point. We’ll...

Jan 19, 2023 | Property Investment

Make it Rain: Debt Reduction & Cash Flow We want our clients to invest in a property to become wealthy. In fact, we want them to make bucket loads of cash week in and week out without needing to lift a finger. From our perspective, it makes sense, if our clients...

Jan 13, 2023 | Property Investment

3 Cures for a Financial Christmas Hangover Christmas is a wonderful time to spend with family and friends, but gee-wiz it can be expensive! In an inflationary environment with a rising cost of living and mortgage rate hikes, seldom do we catch a financial break and...

Nov 30, 2022 | Property Investment

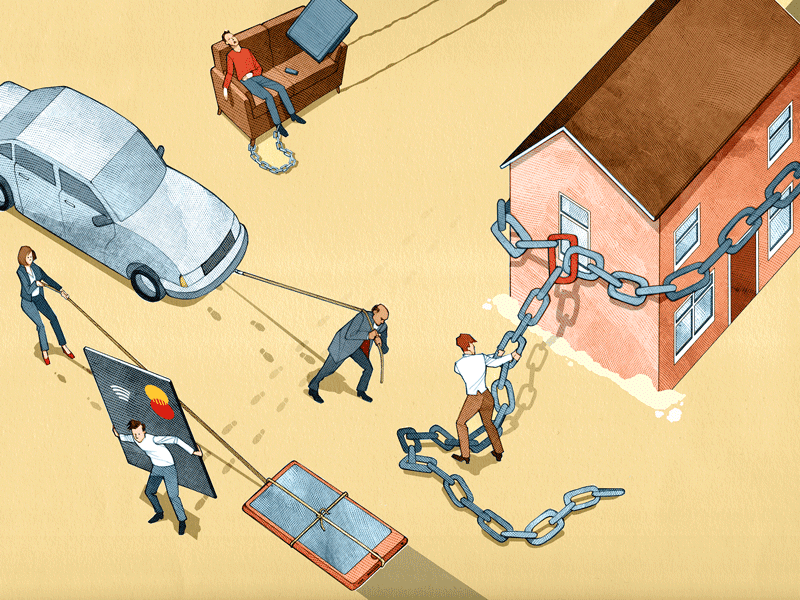

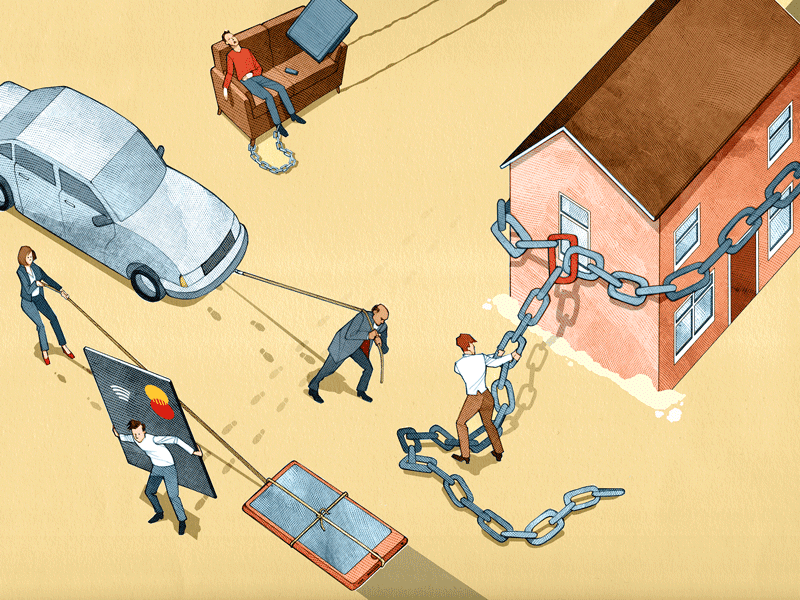

Breaking Debt Shackles Why do some people have multiple investment properties, but most people only have two, one or none? Could it be that some people have learned how to game the system? What if we told you that its not a fancy degree that can unlock this secret,...

Nov 19, 2022 | Property Investment

NDIS presents a smart, secured, and high-returns investment opportunity for Australians. With up to 12% pa gross rental return, easy accessibility, a low-risk profile, and long-term viability, it’s easy to see why property investors rate the NDIS property investment...